Vishal Mega Mart IPO Details

IPO Date: 11th to 13th December, 2024

Total Issue: ~ Rs. 8000 Crores

Price Band: Rs. 74 – Rs. 78 per share

Lot Size: 190 shares and multiples thereof

Purpose of Issue: Offer for Sale

Vishal Mega Mart is a predominantly offline retailer offering products across three major categories, namely apparel, general merchandise and fast-moving consumer goods. It has a Pan India network of 645 stores and has an online presence via its mobile application and website. Vishal Mega Mart Ltd. (VMML) predominantly targets the lower-middle and middle-income families in India.

Industry Overview:

The Indian retail market exhibited high growth, during the period of 2016 – 2019, growing at the rate of 12%. This growth was driven by demographic changes, governmental interventions and changing consumption patterns.

The middle-income segment contributed to this growth, given the increasing disposable income driving demand for branded products, mainly in Tier-2 cities and beyond.

On the Government side, the implementation of GST (Goods and Services Tax) as well as the liberalization of FDI in this sector has helped formalize the retail sector. The growth in the digital payments, such as UPI has made consumer goods more accessible and hence, has boosted retail sales. Governmental welfare schemes have injected higher disposable income in the hands of consumers, thus increasing consumer spending.

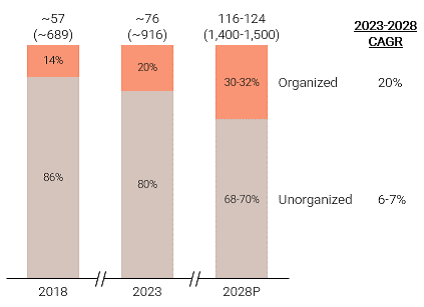

India’s retail market is going towards a more organized direction, with Tier-2 cities driving this change. With the increase in disposable income as well as an increase in urbanization, unorganized retail is being replaced by both the organized brick and mortar stores and online platforms. These platforms are also bringing in new consumers as well as converting users through better efficiency and service.

The Tier-2 cities and beyond are driving this change. In Tier-1 cities, the share of unorganized retail currently ranges from 50% to 55%, which presents a huge runaway for growth. India’s retail market will continue to formalize and will move towards the structures of developed economies such as the USA and China, having 85% - 90% and 50% - 60% organized retail share respectively as of CY23.

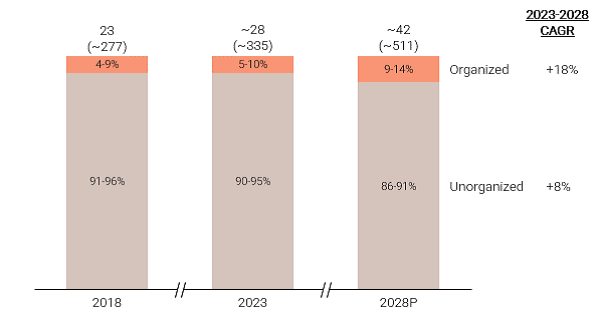

Organized and Unorganized Share

Key growth drivers driving the growth in organized retailers

- Better Selection & Price

- Improved Customer Experience

- More Agility & Insights

- Infrastructure Expansion

- E-Commerce Growth

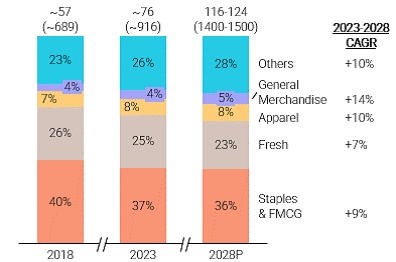

Overall Retail Market by Category

The aspirational retail segment, which is driven by the consumer’s desire for products offering high quality as well as affordability, remains a significant contributor to India’s retail market. Within the categories, top categories such as Apparel, Staples as well as FMCG and General Merchandise have Aspirational Retail shares ranging between 84%-99%.

The total addressable market for the Aspirational Retail segment is roughly between US$820 – $870 billion is expected to grow to US$ 1.25 to 1.35 trillion by CY28. It is expected that while Fresh and Staples & FMCG will still have over 60% of this market, categories such as Apparel and General Merchandise will gain a share.

Categories under Aspirational retail are as follows:

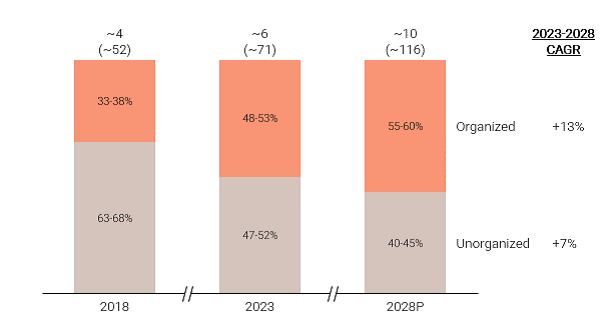

1. Apparel: This market in India was sized at US$71 billion in CY23 and is estimated to reach US$116 billion by CY28, growing at ~10%. Drivers for this growth are:

Media exposure: Digital media as well as social media platforms act as a showcase of the latest fashion trends, inspiring consumers towards these trends. Influencer marketing has further amplified this effect. Thus there is an emergence and rapid growth of multiple mass-mid brands in the country.

Fast Fashion: Significant chunks of India’s population, being under the age of 30, are more likely to be influenced by the latest fashion trends. Adapting to these fashion trends helps the youth elevate their social status

Retail expansion and accessibility: The offline as well as online expansion in retail formats have made Apparel more accessible, especially to people residing in Tier 2 cities and beyond.

The unorganized channel contributes 47% - 52% to the Apparel market in CY23 and has been declining due to the emergence of organized channels, due to increased requirements of quality, and availability of wider selection. Organized channels are expected to account for 55% - 60% by CY28.

Apparel Retail Market Composition (US$ billions)

2. Staples and FMCG: the grocery retail market in India was valued at US$568 billion, with the staples & FMCG accounting for ~59% (US$335 billion) of this market and is projected to grow to reach US$ 511 billion. Key growth drivers for this segment are:

- Changing Consumer Needs: Preference for packaged goods over loose items for hygiene and quality; variety-seeking, convenience-seeking coupled with a craving for better service.

- Health awareness: More attention to organic, healthy, and global foods.

- Organized Retail Growth: Supermarkets and online channels provide a wide range of products with quality and an improved shopping experience.

- Changing Family Structure: Dual-income, nuclear families demand convenient meal solutions and customized personal care products.

- e-Commerce Boom: Fast dissemination for convenience, wide choices, and promotional offers.

The unorganized channel contributed 90-95%of the staples and FMCG market in CY23, but is declining in favour of the organized players.

Staples and FMCG market by channel

3. General Merchandise Market (CY2023-CY2028)

Market Size is estimated to be US$ 37 billion in CY2023, which is estimated to grow to US$ 69 billion by CY2028 at a 14% CAGR. Key growth drivers are:

- Organized Retail Expansion: Penetration into Tier-2 cities and beyond, offering varieties of product assortment under one roof for better convenience, addressing the limitations in the unorganized retail sector.

- Footwear & Fashion Accessories: Growth driven by value-for-money domestic brands with widespread distribution networks while increasing online sales channels enhance access. This is the fastest-growing sub-segment, poised to contribute 61% by CY28.

- Small Household Appliances: Demand for time-saving and convenient appliances like mixer grinders and induction cooktops caters to the increasingly busy lifestyle.

- Home-Centric Trends: Work-from-home culture encourages spending on home décor and furniture.

- DIY and Personalized Décor: Social media inspires the rising DIY culture, therefore creating more demand for home improvement products.

- Travel Revival: The travel boom post-pandemic increases demand for luggage and accessories. The luggage segment is the second fastest subsegment to grow at a CAGR of 15%

Again, the unorganized channel account for 59% to 64% of the general merchandise products and is again on a declining trend in favour of the organized channels. The organized segment is poised to grow to a share of 44% to 49% by CY28.

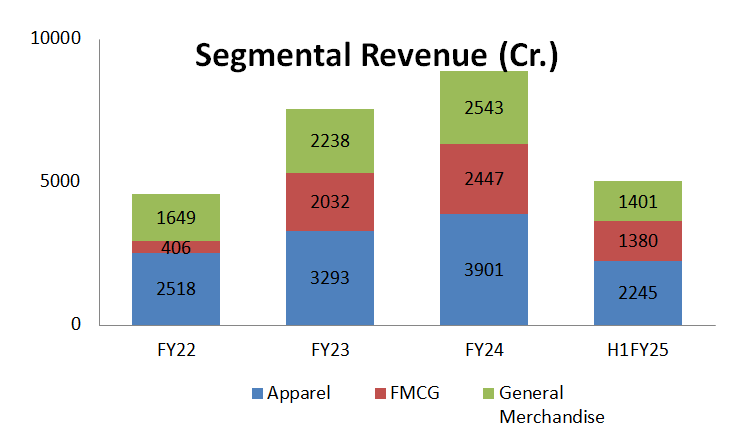

Business Segments:

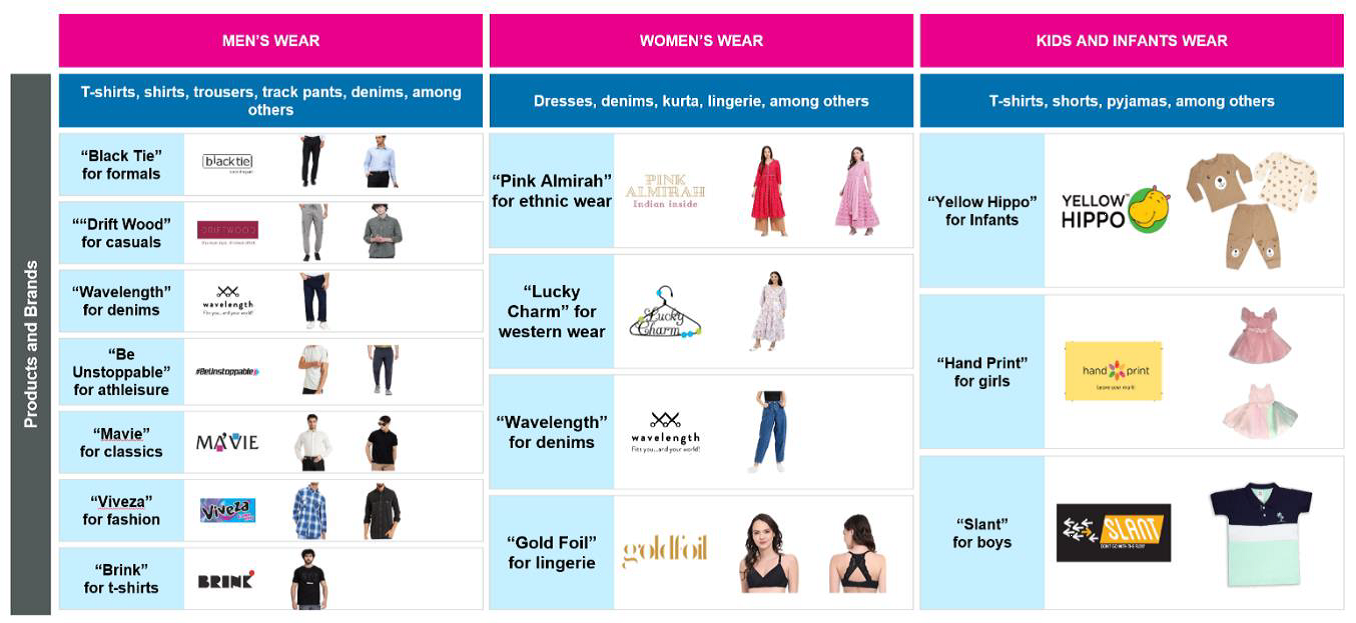

a) Apparel:

VMML’s apparel category comprises exclusively of their own brands offered for all members of a family. The below picture illustrates this.

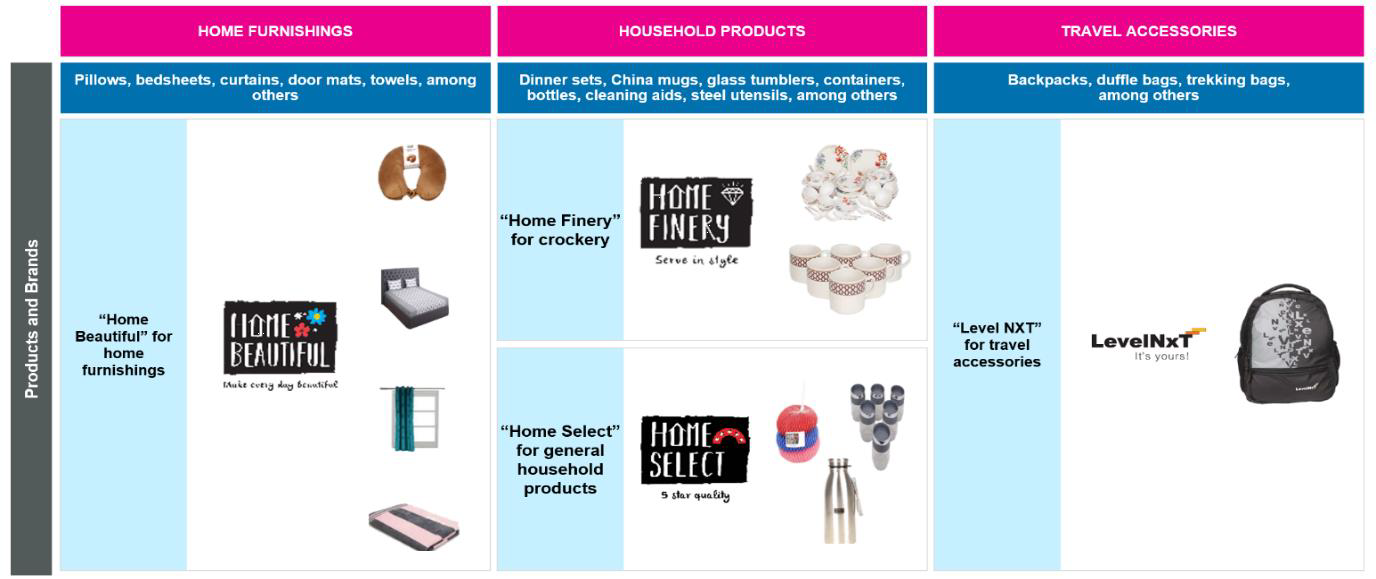

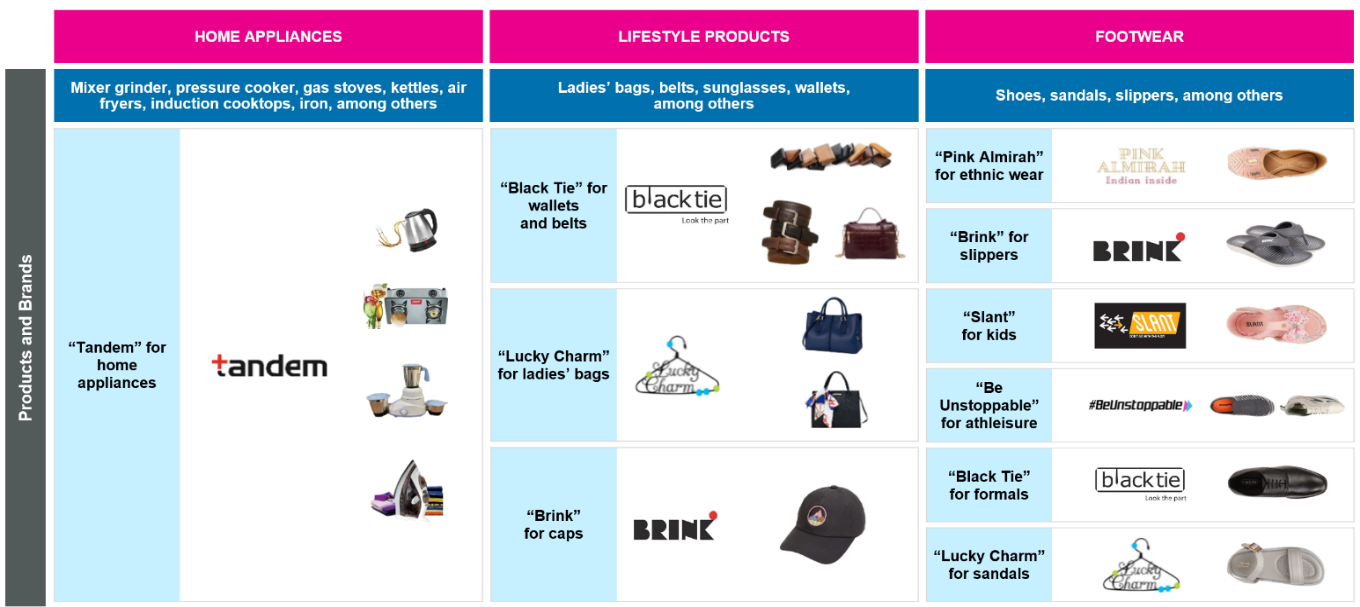

b) General merchandise:

This segment comprises of their own brand as well as third party brand products which cater to Indian family’s household requirements. The below picture illustrates its product offering in the segment.

c) Fast – Moving Consumer Goods:

This category comprises of their own as well as third party products across food, non-food and staples categories. Products sold under this category ranges from biscuits, cake, cookie, milk, detergent powder, shampoos, baby diapers, tooth brush, and men’s’ shaving products.

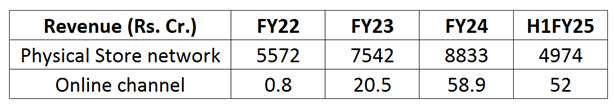

Vishal Mega Mart also has an online presence through its website and mobile application which are operated through its wholly owned subsidiary.

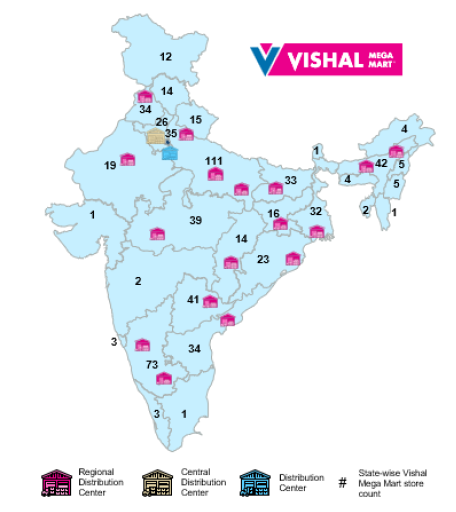

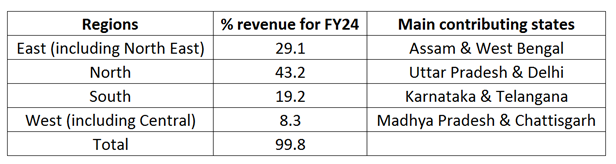

Vishal Mega Mart has 111 stores in the state of Uttar Pradesh, 73 stores in Karnataka, 42 in Assam, 35 Delhi, 34 in Punjab, 32 in West- Bengal and remaining in other states. One point to note is that Vishal Mega Mart has only 2 stores in the state of Maharashtra.

Geographical reach of Vishal Mega Mart

Its average store size is ~17500 sq. ft.

Vishal Mega Mart operates a hub and spoke distribution model or sourcing products and managing their in-store inventory. As of 30th September, 2024, Vishal Mega Mart operates one central distribution centre, one distribution centre and 17 regional distribution centres. These distribution centres are managed by Vishal Mega Mart, while the regional distribution centres are managed by the Promoter, Samyat Services LLP. Vishal Mega Mart operates on an asset light business model with all distribution centres and stores being leased. 2 stores are operated on franchise agreements.

Purpose of Issue:

The issue is entirely Offer For Sale, with the promoter Samyat Services LLP, offloading shares worth ~Rs. 8,000 crores. The promoter LLP is managed by individuals from Kedaara Capital.

Positives:

- Higher margins - VMML does 28% gross margins and 14% EBITDA margins. Gross margins are high on account of own brand sales (~70%). Higher EBITDA margins are reflection of its asset light business model where majority of stores are on lease.

- Higher share of own brands – On an average, 70% of revenue is from own 26 brands across categories. Out of this, few brands have crossed Rs. 500 Cr in sales, with one brands crossing Rs. 1,000 Cr.

- Improvement of working capital days - From average ~40 days of cash conversion cycle before FY23, currently it is at ~12 days. This change happened post FY22, when company started buying inventory directly from suppliers and reduced its receivables.

- Well capitalized balance sheet – Due to asset light business model coupled with lower working capital requirement, company has ~Rs. 700 Cr on balance sheet which can be utilized for expansion.

Concerns:

- Lower revenue per store/sq ft – Revenue per store is lower on account of (a) different geographical mix (focus towards Tier 2 towns), (b) positioning in regions where density is lower and (c) likely because of own brands.

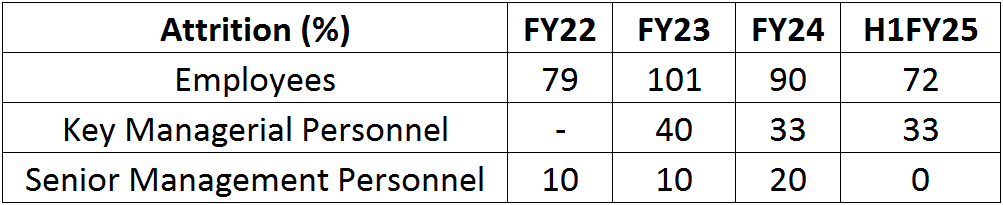

Higher employee costs and attrition- Employee cost is ~6% of revenues, while for industry leader the same stands at ~3%.

- Competitive Intensity and scalability - The company faces competition from larger and more established players like Dmart, Reliance Retail and Trent across different segments. Scalability of this model at similar unit economics needs to be monitored.

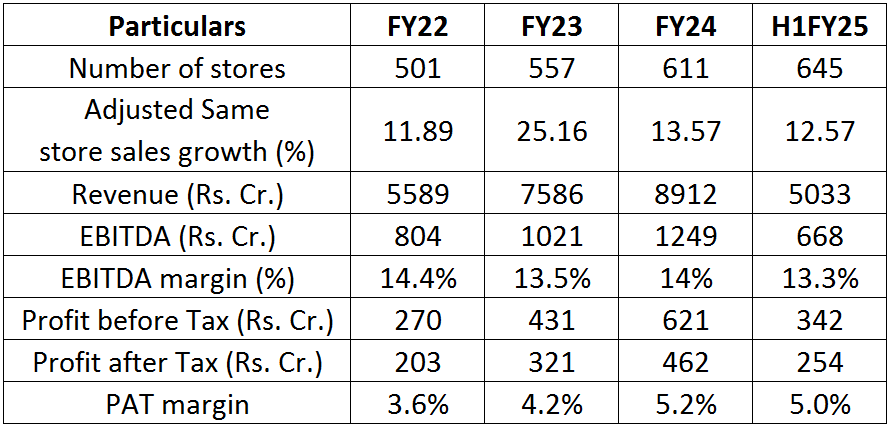

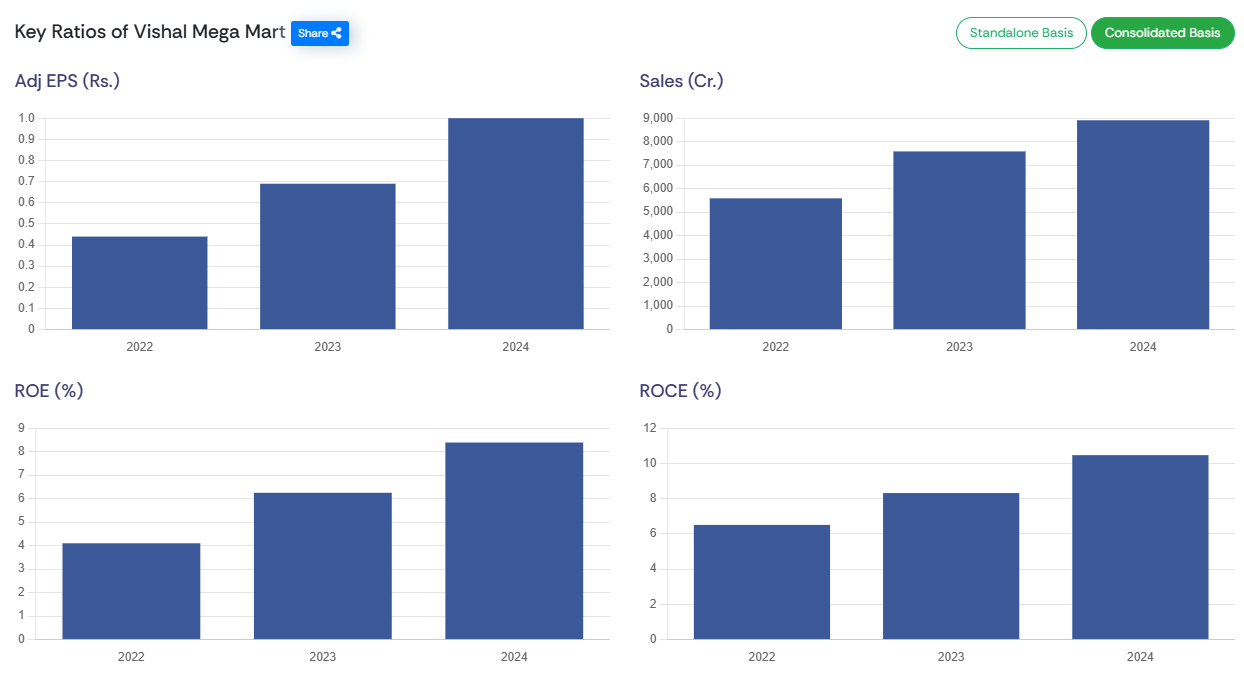

Financials

- Revenue growth over last 5 years has been ~16% CAGR including store additions and growth in existing stores, which is relatively lower, when compared with industry leaders.

- Goodwill on books is Rs. 4,284 Cr, recorded due to merger of Vishal Mega Mart Pvt Ltd. and Rishanth Wholesale Trading Company, which created the present company.

Management:

Gunendra Kapur: He is the Managing director and Chief Executive Officer of the company. He completed his bachelor’s degree (honours) in engineering from the Birla Institute of Technology and Science and MBA from University of Delhi. Previously, he has over 40 years of experience in the sector and was previously associated with Hindustan Levers, Unilever Nigeria, Reliance Industries and TPG capital.

Neha Bansal: She is the Chairperson and Independent director of the company. She completed her bachelor’s degree (honours) in commerce from Gargi College, University of Delhi. She is a member of the Institute of Chartered Accountants of India and has completed a course on valuations and a post qualification course in IT systems audit held by the institute. She is also the co-founder of Lenskart.

MoneyWorks4Me Opinion:

Vishal Megamart’s business model differs from peers in few aspects (a) Higher share of own brands, (b) focus on Tier II locations. Setup cost is lower on account of geographical mix as well as asset light business model (taking stores on lease). For a retail model to flourish, scale benefits need to be achieved. Given lower revenue per store/sq.ft these benefits are not achieved. With a well-capitalized balance sheet scalability of business model needs to be monitored. At 77x PE, company is richly valued and hence, we recommend avoid subscribing to this IPO.

Vishal Mega Mart Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | December 11, 2024 |

| IPO Close Date | December 13, 2024 |

| Basis of Allotment Date | December 16, 2024 |

| Refunds Initiation | December 17, 2024 |

| A credit of Shares to Demat Account | December 17, 2024 |

| IPO Listing Date | December 18, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 190 | Rs. 14,820 |

| Maximum | 13 | 2470 | Rs. 192,660 |

Vishal Mega Mart Limited IPO FAQs:

When will the Vishal Mega Mart Ltd IPO open?

Vishal Mega Mart IPO will open for subscription on Wednesday, December 11, 2024 and closes on Friday, December 13, 2024.

What is the price band of Vishal Mega Mart Ltd IPO?

The price band for Vishal Mega Mart Ltd IPO is Rs. 74-78/share.

What is the lot size for the Vishal Mega Mart Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 190 shares, up to a maximum of 13 lots i.e. Rs. 1,92,660/-.

What is the issue size of the Vishal Mega Mart Ltd IPO?

The total issue size is ~ Rs. 8000 Cr.

When will the basis of allotment be out?

Allotment will be finalized on December 16th and refunds will be initiated by December 17th. Shares allotment will be credited in Demat accounts by December 17th.

What is the listing date of Vishal Mega Mart Ltd's IPO?

The tentative listing date of the Vishal Mega Mart IPO is December 18th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks.

With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: